Home | Finance & Benefits | Shared Ministry

SHARED MINISTRY/STEWARDSHIP

“Imagine a brother or sister who is naked and never has enough food to eat. What if one of you said, ‘Go in peace! Stay warm! Have a nice meal!’? What good is it if you don’t actually give them what their body needs? In the same way, faith is dead when it doesn’t result in faithful activity.” - James 2:15-17 (CEB)

United Methodists are a connected people, bound by a shared mission to love, serve, and give in response to God’s grace. Our generosity isn’t just an act of kindness, it’s how we move beyond the church walls to bring education, healing, leadership, and hope to a world in need.

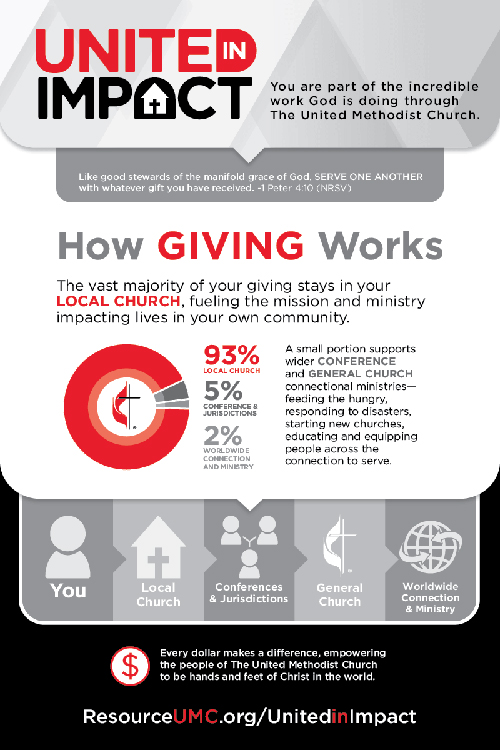

When you give to your local United Methodist church, most of that offering supports ministries of the congregation, but a small portion of your gift supports important ministries and mission work across the country and around the world.

This shared giving, or "apportioned giving," allows United Methodists everywhere to work together to care for others and spread hope where it's needed most. Generosity unites us in impact and enables us to do more together than we ever could alone.

For apportionment payments to count for the 2025 calendar year, they must be received at the East Ohio Conference office on or before Tuesday, January 6, 2026.

Checks should be mailed to the Conference office: 8800 Cleveland Avenue NW, North Canton, OH 44720.

Please note:

Annual Conference 2025 approved a new formula for calculating church apportionments. The recommendation from the Conference Council on Finance & Administration that was approved by Annual Conference 2025 states that: “apportionments to local churches be based on non-benevolent and non-building expenditures (referred to as ‘total base figure’). A ‘grade figure’ will be derived for each local church so that it may readily figure its share of any Conference-budgeted item.”

Your Local Church Total Base Figure Divided by the Conference Total Base Figure

Total Base Figure = church program expenses + other current expenses + salary paid to the pastor and associates + travel paid to the pastor and associates + utilities for the pastor and associates. The total base figure is listed annually in The Conference Journal.

Travel at the Conference-approved rate per vouchered mile for each pastor and/or diaconal minister will not be counted in total base figure. If a flat rate or allowance is used, the total amount is taxable to the recipient, and the total amount will be included in the calculation of the total base figure.

Moving expenses paid by the church are not added to the total base figure but must be reported by each church as outlined in the local church report to annual conference.

Health insurance premiums for lay and clergy paid directly by the charge shall not be considered in establishing the charge's apportionments.

Pension provided for lay employees is not considered in establishing the charge's apportionments. Pension charges billed directly to the local church/charge for clergy shall not be considered in establishing the charge’s apportionments.

Housing allowance for apportionments shall exclude amounts expended on either rent or mortgage and interest payments. Taxes, maintenance, insurance, and utilities will remain a part of the formula.

This churchwide initiative celebrates our connection and the power of connectional giving—our way of sharing the support for the ministry and mission. Our collective generosity reaches into communities near and far—bringing education, healing, leadership, and hope. It means no church, pastor, or layperson serves alone. Together, we are the Church at work in the world.

Vera Milanovic

Executive Director, Financial &

Administrative Services

Ext. 123

The East Ohio Conference Office:

located in North Canton, OH,

near Akron-Canton Airport.

Address:

8800 Cleveland Ave. NW.

North Canton, OH 44720

Phone:

(330) 499-3972

Office Hours:

Monday through Friday

8:30 a.m. - 4:00 p.m.

© East Ohio Conference. All Rights Reserved.