Home | Finance & Benefits | Compass Retirement Plan

COMPASS RETIREMENT PLAN

Compass retains the same eligibility rules of the Clergy Retirement Security Program (CRSP), so bishops and full-time

clergy who are eligible for CRSP today will be eligible for Compass in 2026.

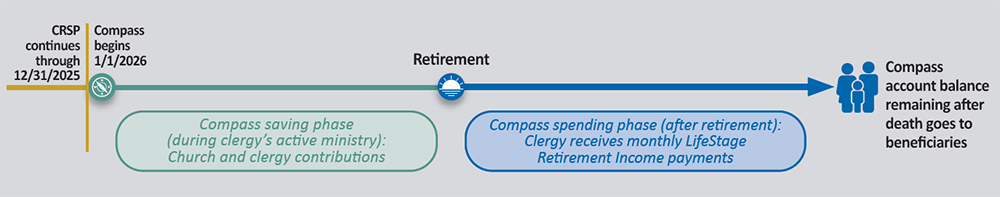

Compass is an account-based plan. Both the Church and clergy make contributions.

A flat dollar contribution provides a base level of retirement savings to more fairly distribute benefits than a solely pay-based plan.

Compass provides lower-paid clergy with a higher relative level of income replacement. Clergy will receive a flat dollar contribution of $150 per month, which will increase by 2% each year (in $5 increments).

Compass provides matching contributions on qualified student loan payments made by clergy. In essence, the plan treats clergy’s student loan payments as if they are clergy contributions, and then provides an appropriate match as if such payments had been clergy contributions to the plan. To receive this match, clergy must certify annually how much they made in student loan payments for that year. Repayment of student loans taken for family members are not eligible for this program.

Under Compass, the deemed value of a parsonage is 35% of base pay.

Automatic features simplify saving for retirement.

Automatic features are optional (but highly recommended). Clergy can opt out at any time.

LifeStage Retirement Income is a required feature for managing the account balance the plan sponsor (i.e., the Church) has contributed to Compass. It is designed to optimize monthly payments to help the account last throughout the clergy’s lifetime (and the spouse’s lifetime, if applicable). The online tool demonstrates various retirement income scenarios including two optional features.

Clergy who have earned a pension in the defined benefit plans will retain those benefits. For the Clergy Retirement Security Program defined benefit (CRSP DB), clergy compensation used to determine benefits is the Denominational Average Compensation (DAC). The DAC will continue to increase 2% annually through retirement.

Robin Whitacre

Benefits Manager

Ext. 151

The East Ohio Conference Office:

located in North Canton, OH,

near Akron-Canton Airport.

Address:

8800 Cleveland Ave. NW

North Canton, OH 44720

Phone:

(330) 499-3972

Office Hours:

Monday through Friday

8:30 a.m. - 4:00 p.m.

© East Ohio Conference. All Rights Reserved.